Do you want to find out more about the whole guide to Indian Chartered Accountants (CAs’) pay in the USA in 2023? Fortunately, we’d walk you through finding out more about the salary of Indian CA in the USA, the salary potential, determining variables, and employment chances for Indian CAs in the US.

Indian CAs’ Salaries In The USA

The professional knowledge and financial savvy of Indian Chartered Accountants (CAs) are well-known. With a solid basis in accounting, auditing, and taxation, Indian CAs frequently look for international chances to advance their careers. For many Indian CAs, the United States has emerged as their favorite location due to its robust economy and diverse business environment.

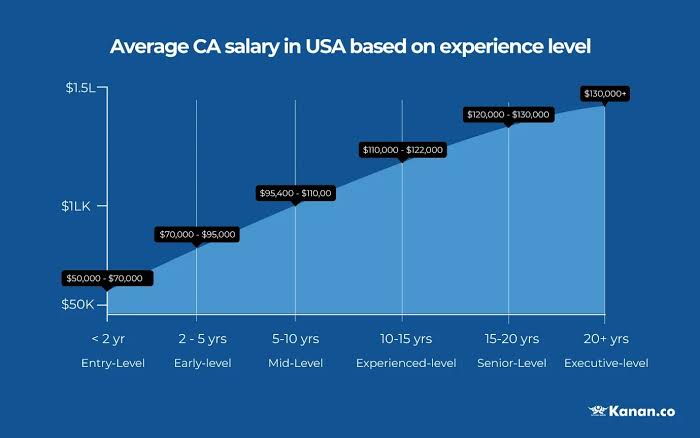

Entry-Level Positions

Indian CPAs sometimes begin their careers as junior accountants, financial analysts, or tax advisors. The beginning pay for these positions normally varies from $50,000 to $70,000 per year. However, it’s important to keep in mind that particular numbers may vary depending on the region, size, and sector of the company.

Experience Matters

Indian CAs’ earning potential increases as they get exposure to the US labor market and develop a deeper understanding of American accounting standards and procedures. They can anticipate large income rises after a few years of experience. The typical salary range for mid-career workers is between $80,000 and $120,000.

Qualifications and Specialisations

Acquiring further qualifications, like the Certified Public Accountant (CPA) or the Chartered Financial Analyst (CFA), can significantly increase earning potential. These credentials are highly valued in the US and can lead to higher-paying positions. For instance, earning a CPA license may result in yearly salaries of far over $100,000.

Sector and Location

The sector in which Indian CAs work has a big impact on their pay. Higher pay is typically offered in the finance, technology, and healthcare industries. Location is also quite important. Due to the higher cost of living in large financial centers like New York City, San Francisco, or Chicago, employment there frequently results in higher pay.

Job Roles

Positions inside an organization can range from CFOs to financial analysts. With yearly compensation that could surpass $200,000, chief financial officers (CFOs) are among the top earners. These positions, however, often call for a high level of experience and knowledge.

Public vs. Private Sector

Salary arrangements for Indian CAs employed by the public sector—such as by governmental or nonprofit institutions—could differ from those of those employed by the private sector. Salary ranges for jobs in the private sector are often higher.

Salary Influencing Factors

The following factors may affect the pay of Indian CAs in the USA:

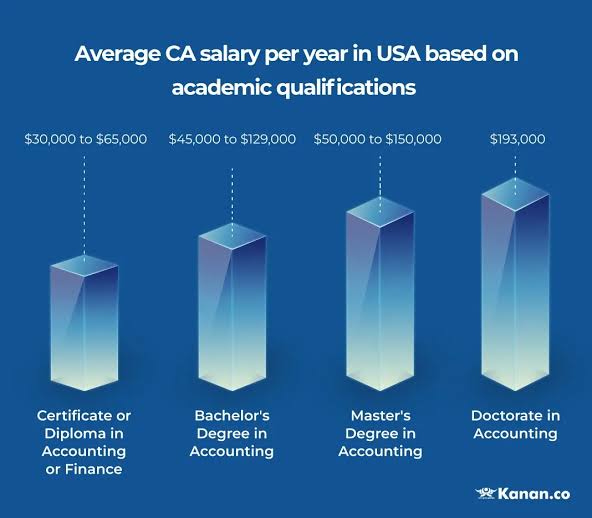

Education and Qualifications:

Having an Indian CA designation is a great place to start, but higher-paying positions may also be attainable with additional credentials like a master’s degree or professional certifications like the CPA or CFA.

Work Experience:

Knowledge of American accounting, auditing, tax, or financial management procedures can have a significant impact on earning potential.

Location:

Salary levels in the USA vary greatly by region. Because of the higher cost of living, urban areas and financial hubs frequently offer higher pay.

Firm Size:

Salaries at large, prestigious companies and global enterprises are frequently higher than at smaller businesses.

Specializations:

Some Indian CPAs opt to focus on disciplines like forensic accounting, mergers & acquisitions, or tax planning. Specializations may provide doors to opportunities with higher pay.

Career Opportunities And Its Correlation To Salary Of Indian CA in The USA

Concerning the salary of an Indian CA in the USA, here’s a brief description of some career options to consider:

Auditors:

Auditors are essential in maintaining financial openness and legal compliance. Public accounting firms, governmental institutions, and businesses are just a few of the places where they work. Indian CAs with experience in auditing frequently review financial statements, assess internal controls, and provide recommendations to increase the accuracy of financial reporting. They might also focus on forensic accounting or risk analysis. This career path offers a wide variety of opportunities, from working as an external auditor for recognized organizations to

conducting internal audits within corporations.

Tax consultants

Tax consultants are experts in Indian CAs who help people and organizations manage complicated tax laws. They provide services like tax planning, returns preparation, and dispute representation while assisting them in optimizing tax strategies, reducing liabilities, and assuring compliance.

Financial analysts

Financial analysts do research, offer investment advice, and assist in planning by analysing financial data, market trends, and economic situations. Indian CAs excel in this field, working for banks, investment companies, corporate finance divisions, and governmental organizations.

Consultant

Indian CAs who have specialized knowledge in fields like mergers and acquisitions, forensic accounting, risk management, or financial consulting frequently work as consultants. They offer clients specialized services that aid in navigating difficult financial issues. For Indian CAs who have polished their talents in certain areas, the high demand for specialized financial advice services in the USA makes this a lucrative career path.

Academic careers and teaching

Some Indian CPAs choose to teach accounting and finance at schools and universities, where they may share their knowledge and experience. They can contribute to the professional growth and education of aspiring accountants and financial professionals thanks to their chosen job path. They might carry out research, write scholarly articles, and influence the next group of financial experts.

Challenges With Salary Of Indian CA in The USA

There are difficulties to take into account, even if the USA presents great employment chances for Indian CAs:

Licencing Requirements

Indian CAs must fulfill particular licensing requirements and pass the relevant tests if they want to work in professions like CPA or CFA.

Cultural Adaptation

Although it can be difficult, success depends on your ability to adjust to a new workplace culture and comprehend the American business landscape.

Networking

It’s essential to establish a professional network. Indian CAs should take advantage of online resources like LinkedIn, attend business events, and join professional organizations.

Constant Learning

It’s critical to stay current with the USA’s growing accounting standards and laws. Indian CAs should make investments in their ongoing education and growth as professionals.

Conclusion

Several variables, such as education, experience, location, and industry, affect the pay of Indian CPAs in the USA. In a variety of positions, from auditor to CFO, Indian CAs might make a competitive living. For lasting achievement in the United States, it is crucial to comprehend the licensing criteria, adjust to the American workplace, and devote money to professional growth. The United States presents a multitude of options and the possibility of having a significant impact on the financial and accounting industries for Indian CAs looking to expand their perspectives while adding to the American economy.